A bull-bear phase spread can be constructed using near month call put. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price but different expiration periods.

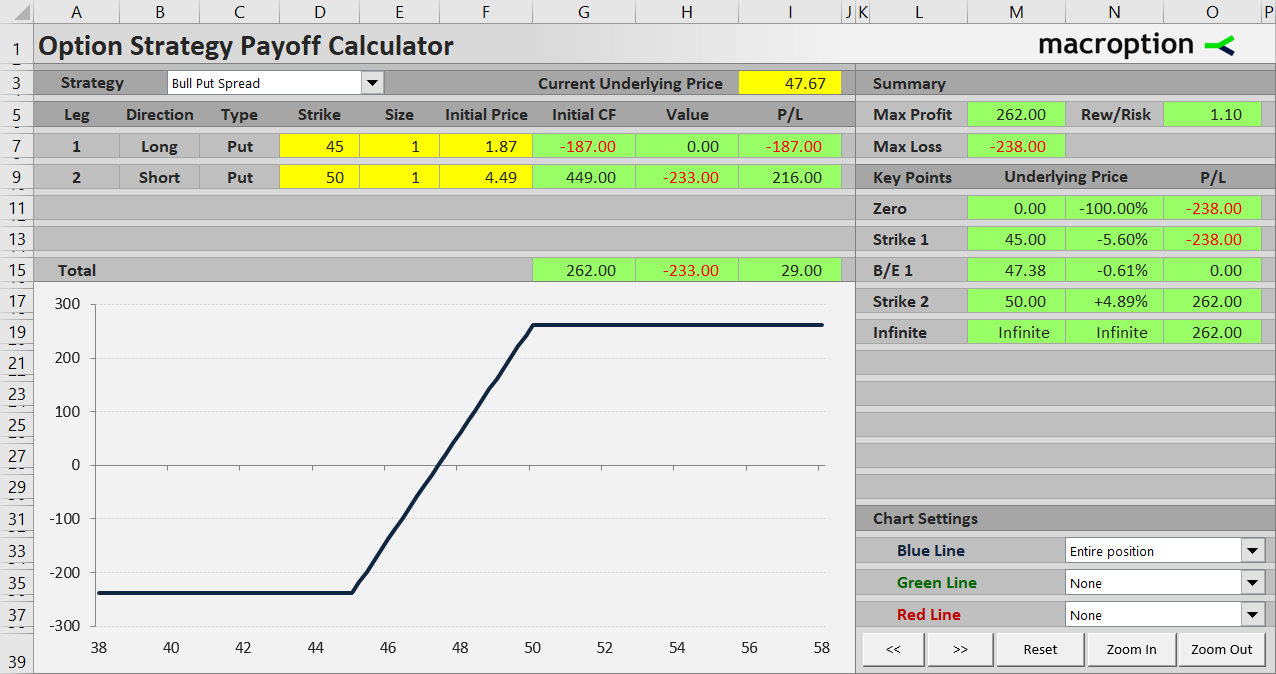

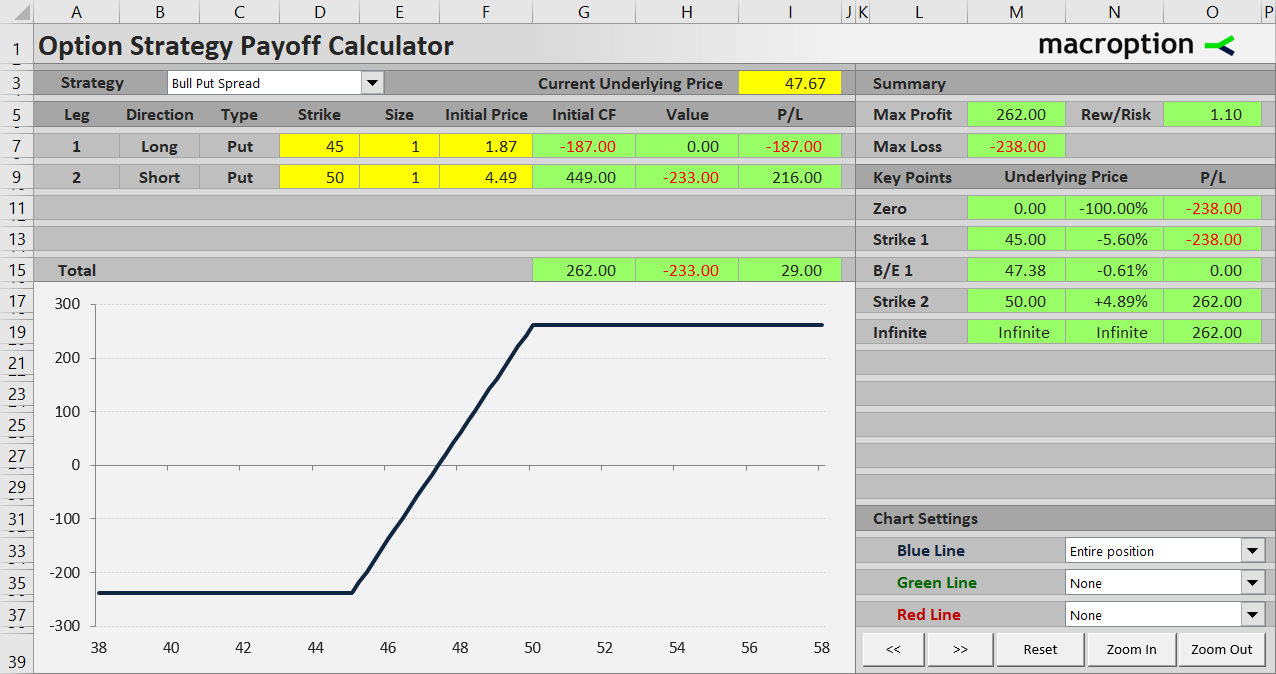

Bull Put Spread Payoff Break Even And R R Macroption

Bull Put Spread Explained Best Guide W Examples Projectoption

Calculations For The Bull Put Credit Spread Options Money Maker

It is sometimes referred to as a horizonal spread whereas a bull put spread or bear call spread would be referred to as a vertical spread.

Bull put spread breakeven. The bull put spread strategy has other names. If you want a copy just click the button below put in your email and you will get a copy straight away. Breakeven for put spreads higher strike - net premium.

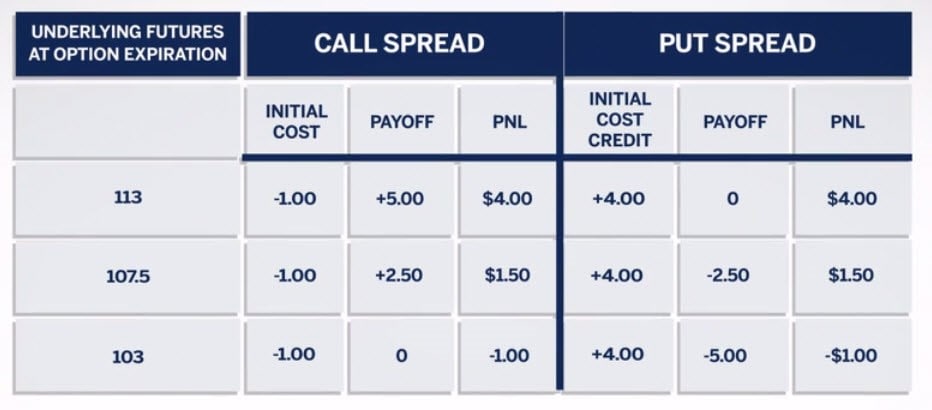

A bull call spread is a type of vertical spread. A bull calendar put spread is similar but uses a slight tweak. The breakeven price of a put credit spread is the short puts strike price minus the credit received.

Buy the weekly at-the-money put option for Walmart WMT with a strike price of 95 priced at 119. A bull put spread is a variation of the popular put writing strategy in which an options investor writes a put on a stock to collect premium income and perhaps buy the stock at a bargain price. A Straddle is where you have a long position on both a call option and a put option.

An options trader believes that XYZ stock trading at 42 is going to rally soon and enters a bull call spread by buying a JUL 40 call for 300 and writing a JUL 45 call for 100. Earnings Sniper Spread Our third trademark options strategy invented by Bang Pham Van. ZeroHedge - On a long enough timeline the survival rate for everyone drops to zero.

A futures contract is a contract between two parties where both parties agree to buy and sell a particular asset of specific quantity and at a predetermined price at a specified date in future. Breakeven Points There are 2 break-even points for the ratio spread position. The payment and delivery of the asset is made on the future date termed as delivery date.

Bear Call Spread Vs Bear Put Spread. Options Trading Excel Straddle. To find the credit spread breakeven points for call spreads the net premium is added to the lower strike price.

Create similar worksheets for Bull Put Spread Bear Call Spread and Bear Put Spread. Hopefully by the end of this comparison you should know which strategy works the best for you. As a result the bull put spread trader had approximately 147 in losses per spread 353 Put Spread Sale Price - 500 Current Spread Price x 100 Option Contract Multiplier -147.

Thats because if the stock price is at 9850 at expiration the 100 put will be worth 150 while the 95 put will be worthless which means the value of the spread will be 150. It contains two calls with the same expiration but different strikes. Fortunately NFLX shares surged from 140 all the way up to 160 and the stock price was trading at 15702 at the time of the short put spreads expiration date.

Breakeven Point Rs 17725 Rationale. The breakeven price. 10000 180 10180.

Bear spread Strategy on NIFTY Buy NIFTY 17800 PUT at Rs 122 simultaneously sell 17500 PUT at Rs 47 EXPIRY 03 NOV Lot Size 50 Cost of the strategy Rs 75 Rs 3750 per strategy Maximum profit Rs 11250 If NIFTY closes at or below 17500 on 03 Nov expiry. Bull put spread. Breakeven stock price at expiration Strike price of long call lower strike plus net premium paid.

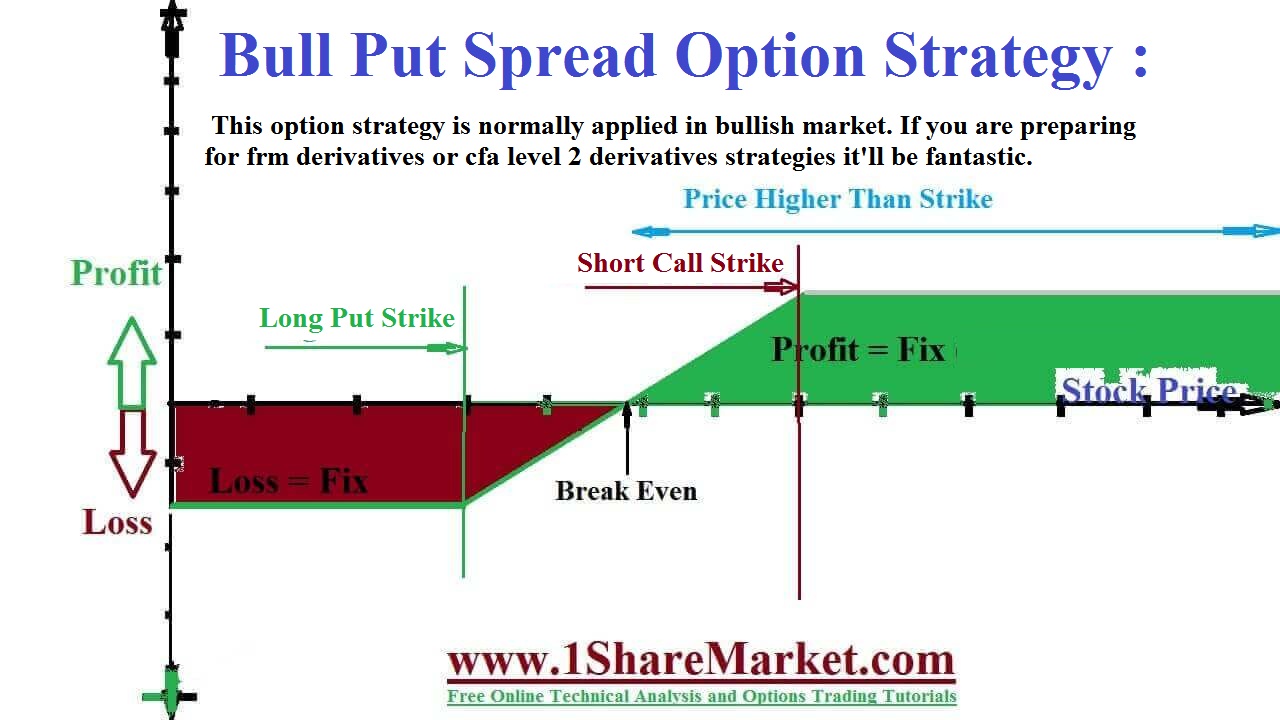

Breakeven for call spreads lower strike net premium. A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. The net investment required to put on the spread is a debit of 200.

Ive created a very simple excel based calculator that can be used for both bear call spreads and bull put spreads. The term credit refers to the fact that the strategy is created for a net credit or net amount received. Entry Credit 150.

Therefore we can generalize the breakeven point for a bull call spread as Lower Strike Net Debit The strategy makes money if the market moves above 7854 however the maximum profit achievable is Rs46 ie the difference between the strikes minus the net debit. The buyer in the futures contract is known as to hold a long position or simply long. This is implemented when you expect the stock to change significantly in the near future but are unsure of which direction it will swing.

It is also known as a credit put spread and as a short put spread The term bull refers to the fact that the strategy profits with bullish or rising stock prices. Bull Call Spread Example. The breakeven points can be calculated using the following formulae.

The strategy looks like this. The Bull Put Spread is similar to the Bull Call Spread in terms of the payoff structure. There may even be a profit if a credit is received when putting on the spread.

The breakeven point for the bull put spread is 38420 which is calculated as 385 less the 80 cents per share option premium per contract. Here you buy and sell put options with the same strike price but mix up the expiration dates. Breakeven Point Strike Price of Long Call Net Premium Paid.

For put spreads the net premium is subtracted from. ZeroHedge - On a long enough timeline the survival rate for everyone drops to zero. In this case thats 9850 Short Put Strike Price 100.

Bull Put Spread Xtreme Achieve 5 to 15 per month 60 to 120 per year with a high probability win rate 90. The strike price of the short call is higher than the strike of the long call which means this strategy will always require an initial outlay debitThe short calls main purpose is to help pay for the long calls upfront cost. In our coffee bull put spread maximum loss is calculated by taking the value of the spread 55 - 50 005 cents x 375 1875 and subtracting the premium received 0029 received for the 55.

Bull calendar put spread. This strategy breaks even if at expiration the stock price is below the upper strike short put strike by the amount of the initial credit received. In this Short Strangle Vs Bear Put Spread options trading comparison we will be looking at different aspects such as market situation risk profit levels trader expectation and intentions etc.

The bull put spread involves creating a spread by employing Put options rather than Call options as is. See bear put spread. However there are a few differences in terms of strategy execution and strike selection.

Enjoy a wide profit range and high probability win rate without picking a price direction. The maximum gain and loss potential are the same for call and put debit spreads. The bear call spread and the bear put spread are common examples of moderately bearish strategies.

Any risk to the downside for the call ratio spread is limited to the debit taken to put on the spread if any. A bull put spread involves being short a put option and long another put option with the same expiration but with a lower strike.

Bull Put Spread Short Put Spread Option Strategies Insider

Long Put Spread Bull Put Spread The Options Playbook

Bull Spread

Bull Put Spread Break Even Price Youtube

How Does A Bull Call Spread Work Our Expert Explains Commodity Com

/BullPutSpread-56a6d2315f9b58b7d0e4f791.png)

Bull Put Spread Definition

Bull Put Spread Option Strategy With Example

:max_bytes(150000):strip_icc()/dotdash_final_Vertical_Bull_and_Bear_Credit_Spreads_Dec_2020-01-0e08d947cab04fb38af6125ff61141bb.jpg)

Vertical Bull And Bear Credit Spreads