Our team of seven estate attorneys has extensive courtroom experience successfully litigating complex and often emotionally charged legal issues. Will not from any linkage groups.

Sara Kline Period 6 32510 Alport Syndrome What

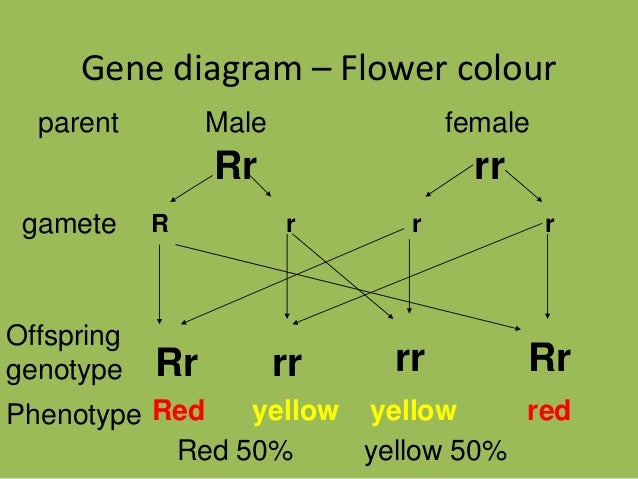

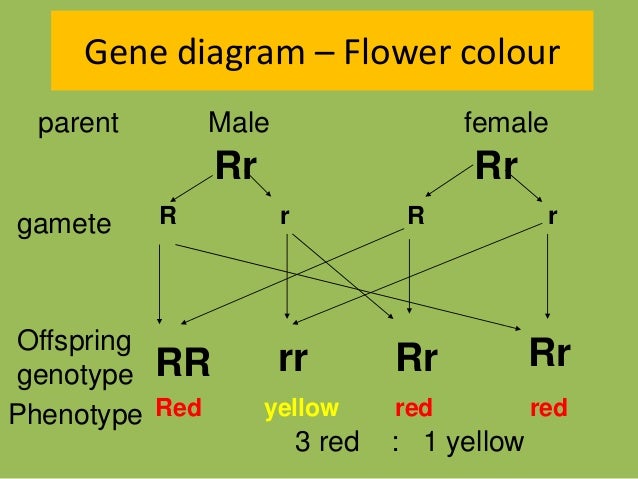

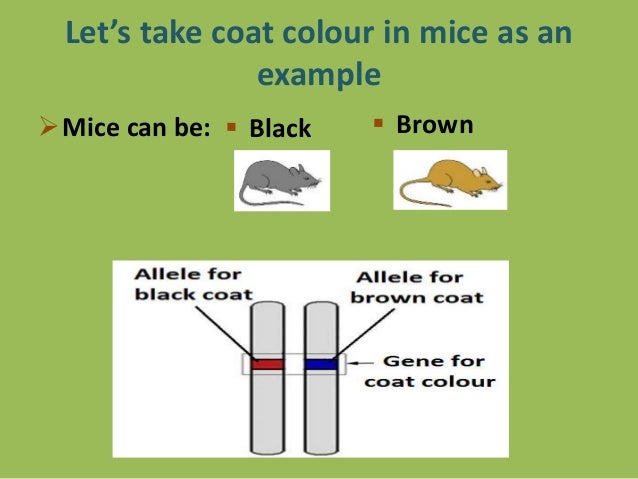

Biology Form 5 Chapter 5 5 1 Inheritance

Hebat Spm 2019 Biology Form 5

The outcomes of such lawsuits depend on the underlying facts and circumstances.

Inheritance form 5. Private members of parent class. Hybrid inheritance is a combination of two or more types of inheritance. Enter the information for the asset.

_____ Waive all my rights of inheritance _____ Waive my right to _____ of Shares Number This Waiver of Rights is made with my knowledge that stock in OC may have potential future value even though at present it has no ascertainable market value. New versions of the IHT400 form IHT400 Notes for 2018 to 2019 have been added to the page. Return of estate information IHT207 2006 10 July 2020.

Under the new law individuals will be required to file a refund claim on a Claim for Refund Form IH-5 with DOR. For example Java Hybrid Inheritance. However many banks could be very understanding and unfreeze some money for the relatives to be able to pay for immediate expenses eg.

And yes both types of taxes are levied by Maryland and New Jersey although New Jersey will only have an inheritance tax for 2018. 4 April 2014 Form Inheritance Tax. As solutions are framed by the experts NCERT Solutions have been deemed the best tool for the CBSE students for their academic requirements.

Schedules A through G are used to report assets of the estate. What are the genetic causes of SMA. The estate of the deceased must file individual state and income tax returns one final time due by the tax deadline in the year immediately following their death.

With offices in Los Angeles San Francisco San Diego County Orange County. Point 5 of biblical history is the same as point 5 of biblical social theory. Chapter 5 Principles of Inheritance and Variation of Class 12 Biology is categorized under the term I CBSE Syllabus for 2021-22.

The 2013 legislature made changes in the filing of refunds for inheritance tax. Currently the law imposes a. Basically it is a blend of more than one type of inheritance.

This is usually a cash endowment given to children or grandchildren but an inheritance may also include assets like stocks and real estate. Once a review of the form is complete an acknowledgment. Inheritance tax forms schedules and instructions are available at wwwrevenuestatepaus.

License plateRegistration Vehicle identificationVessel hull identification VINHIN Year Make Model Body style. Box 280601 Harrisburg PA 17128-0601 FAX. Enter the information for the decedent associated with the.

An updated version of the Inheritance Tax account IHT400 form has been added. The most common form of SMA types 1-4 is caused by a defect mutation in the SMN1 gene on chromosome 5. Michigan does not have an inheritance tax with one notable exception.

How Inheritance Works When Theres a Will. This form must be completed as instructed below. All genes located on the same chromosome.

CausesInheritance What causes spinal muscular atrophy SMA. Hierarchical inheritance More than one derived classes are created from a single base. SMA is characterized by the loss of motor neurons nerve cells in the spinal cord.

Eligible designated beneficiaries EDBs are anyone designated by the IRA owner who is. Asset distribution is determined during the estate planning process when wills are written and heirs or. Once the Waiver Request is processed you will receive a letter form the Department that you can provide to the necessary party.

When someone dies and there is no living spouse survivors receive the estate through inheritance. Inheritance Complete this section when no executor or administrator is appointed for the deceased. Analysis Psalm 110 is quoted directly or referred to indirectly more often in the New Testament than any other Old Testament passage.

Form one linkage group. However a creditor could sue you demanding immediate payment. Access Solution for NCERT class 12 Biology exemplar for chapter 5 Principles of Inheritance and Variation.

Inheritance Realty Transfer Tax Division - Waiver Request PO. Founded in 2008 Albertson Davidson serves abused beneficiaries who are facing financial battles over trusts wills and probate matters in California. In object-oriented programming inheritance is the mechanism of basing an object or class upon another object prototype-based inheritance or class class-based inheritance retaining similar implementationAlso defined as deriving new classes sub classes from existing ones such as super class or base class and then forming them into a hierarchy of classes.

It is classified as a motor neuron disease. Its applied to an estate if the deceased passed on or before Sept. Submit this form with the vehicle or vessel title and a copy of the death certificate.

As of 2012 Form 706 is filed by the executor of the decedents estate if the adjusted taxable gift and specific gift exemption plus the gross value of the decedents estate exceeds 35 million. The United Kingdom like many other countries has. Form interactive groups that affect.

The passing on of private property andor debts can be done by a notary. This form combines more than one form of inheritance. Services for people with special hearing andor speaking needs are available at 1-800-447-3020.

Here we have combined hierarchical and multiple inheritance to form a hybrid inheritance. An inheritance tax is levied by Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. When a person dies all their assets are frozen.

Inheritance is the practice of passing on private property titles debts entitlements privileges rights and obligations upon the death of an individualThe rules of inheritance differ among societies and have changed over time. The Inheritance Tax is a credit against the Estate Tax. Enter the information of the entity that maintains the.

This new requirement applies to any claim for refund whether the. 1 their spouse 2 a minor children 3 a chronically ill individual 4 a disabled individual or 5. 360 902-3770 option 5.

Your creditors cannot take your inheritance directly. Form different groups depending upon their relative distance. Return of estate information IHT205 for deaths before 6 April 2011.

Both federal and state income tax returns. At least 27 times according to James Montgomery Boice. An estate pays only the higher of the two.

Federal Estate and Gift Tax Exemptions. You may also order any Pennsylvania tax form or schedule by calling toll-free 1-800-362-2050. Form Inheritance Tax.

New Jersey has had an Inheritance Tax since 1892 when a 5 tax was imposed on property transferred from a deceased person decedent to a beneficiary. Sometimes a beneficiarys own creditors attempt to obtain payment of the beneficiarys financial obligations after an inheritance. If you are filing for a nonresident alien use Form 706-NA.

Rapid Revision Kbsm Biology Form 5 Chap 5 Inheritance Youtube

Biology E Book Pages 1 50 Flip Pdf Download Fliphtml5

Cycle 5 Notes Mendelian Inheritance Biology 1001a Biology For Studocu

Bluebond How Do You Avoid Inheritance Tax Method 5 Use Reversionary Discretionary Trust After Seven Years Assets Placed Into A Reversionary Trust Will Not Form Part Of Your Estate When

Mendelian Inheritance Wikipedia

Biology Form 5 Chapter 5 5 1 Inheritance

Human Genetic Disease Sex Linked Inheritance Britannica

Biology Form 5 Chapter 5 5 1 Inheritance