Many firms that compete in international markets hope to gain cost advantages. With 1417 constituents as of 29102021 the index covers approximately 85 of the free float-adjusted market capitalization in each country.

Finding Opportunities In Emerging Markets

How To Invest In Emerging Markets In 2021 Investing 101 Us News

What Investors Should Consider In Emerging Markets Wsj

As of February 2021 the funds 34 allocation to Chinese stocks was on par with the benchmark.

Advantages of investing in emerging markets. Five Major Advantages of Choosing Online Insurance over Traditional. A gifted communicator strategist writer and avid blogger Andrea is Managing Director of SAJE a digital communications agency and The Writers Shop a regional collaboration between the best business writers in Asia Pacific. Dollar-denominated and local-currency issues.

Monday through Friday 8 am. To 8 pm Eastern time. Emerging markets EM in our view remain one of the more compelling themes in equities investing but perhaps for reasons not fully appreciated by investors.

How Investing in MLPs Energy Infrastructure Works Max Chen November 5 2021 Energy infrastructure companies are involved in the transportation. Many companies have resisted investing. PNW is committed to delivering improved visibility and brand recognition to companies operating in the emerging markets.

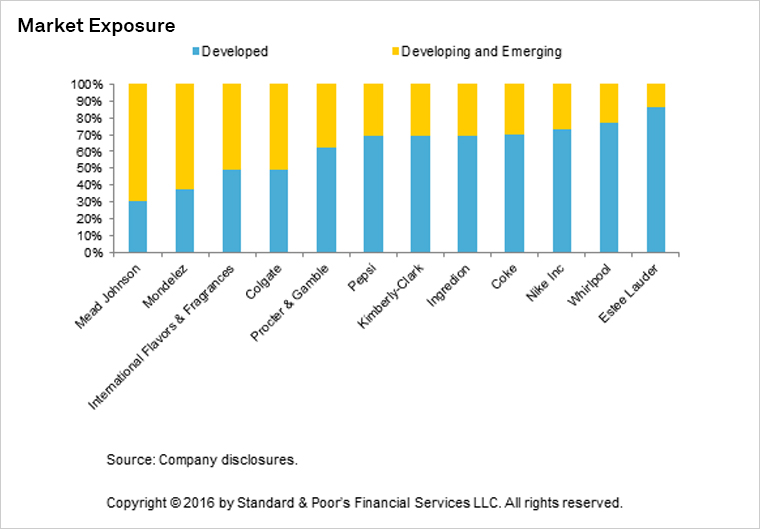

The iShares Core MSCI Emerging Markets IMI UCITS ETF Acc invests in stocks with focus Emerging Markets. Andrea Edwards has worked in marketing and communications all over the globe for 20 years and is now focused on her passion writing. So our job in emerging markets is to figure out how to grow not just our market share but the size of the categories in which we competefor example chocolate.

Access the global capital market neutralizes one of foreign companies key advantages. Diversification allows you to take advantage of growth without being vulnerable to any single stock. China is a good example of an economy that was previously.

The MSCI Emerging Markets is an international equity index which tracks stocks from 27 emerging market countries. The findings demonstrate multiple advantages. Dividend growth investing is always a solid idea although there are times that this more conservative style is destined to be overlooked as more adventurous concepts come into fashion.

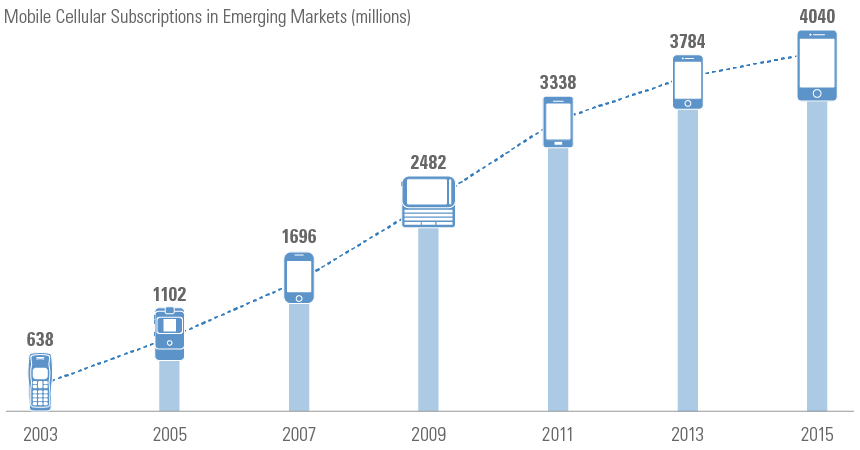

Asset and wealth management Banking and capital markets Consumer markets Energy. The dividends in the fund are reinvested accumulating. Investing in emerging markets The term emerging markets refers to the economies of countries that are undergoing industrialisation as they become more developed and the share of global GDP of these nations is growing rapidly.

Owning mutual funds allows you to own hundreds of stocks selected by the mutual fund manager. Learn about stock investing and read on to see our analysts takes on the latest stock stories. Types of Investments Government debt nominal and inflation-linked quasi-sovereigns and corporate bonds including US.

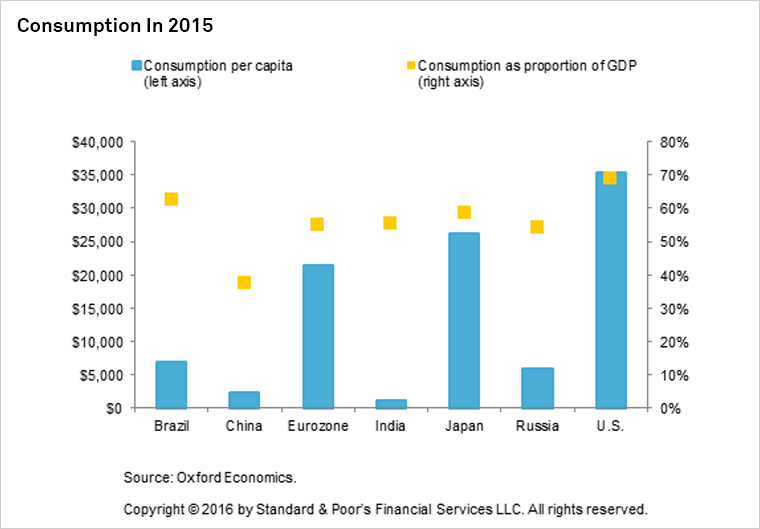

The emerging-market consumer on average eats 500 grams of chocolate per year. Part of the problem is that emerging markets have. For companies in many emerging markets giving up control is the option of last resort.

By FSMOne 02 Sep 2020 2566 views Your one-stop investment platform Explore a wide array of investment products. Risks of Investing in Emerging Markets. The value of assets and liabilities that are in foreign currencies creates the potential of a brand and business becoming immediately less competitive overnight resulting in steep revenue losses.

When a firm increases sales volume by entering a new country for example it may generate economies of scale that lower its overall and average production costs. The wedge between emerging market and US GDP growth is forecast to be its narrowest since 1999 this year as the US enjoys a strong vaccine- and stimulus-led recovery until earlier this month the IMF had been forecasting that US GDP growth would outstrip that of emerging markets this year. Emerging companies Family High net worth individuals Law firms Private equity and portfolio companies US inbounds.

Investing too late in an emerging market is the biggest risk of this type of investment. Like the MSCI Emerging Markets Index it has a growing concentration in the Chinese market. Our stock-picking approach focuses on long-term advantages and intrinsic value.

As of 2020 the 37 markets covered by OBG accounted for around 216 of the worlds population and roughly 96 of global GDP as represented by the yellow. Own companies located in the United States Europe Japan and emerging markets. At present EMs as gauged by leading benchmarks encapsulate 26 countries and more.

We would like to show you a description here but the site wont allow us. Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more. Chart of the Week.

If youre already a Vanguard client. MSCI Emerging Markets Investable Market IMI allows a broad investment with low fees in appr. The total expense ratio amounts to 018 pa.

In the developed world consumers eat five kilograms of chocolate per yearthats ten times more. This also means the exchange rates in those emerging markets may fluctuate wildly making it difficult to forecast finances for budgeting purposes. As pioneers in emerging markets investing this strategy leverages our 20-year track record of managing emerging markets bond portfolios.

This is especially true for the family-owned businesses that play a leading role in most of these economies. Alumni Analyst relations Investing in our people Newsroom Offices Our leadership Purpose and values The New Equation. Covid-19 another headwind for emerging markets by Fathom Consulting.

Investing in emerging and frontier markets both offer the prospect of higher returns and higher risk but emerging market economies are more stable and developed than frontier markets.

Does Investing In Emerging Markets Still Make Sense Financial Times

Emerging Markets May Offer The Most Potential For The World S Largest Consumer Focused Companies S P Global

Does Investing In Emerging Markets Still Make Sense Financial Times

Emerging Markets May Offer The Most Potential For The World S Largest Consumer Focused Companies S P Global

Alternative Investments In Emerging Markets A Review And New Trends Sciencedirect

1

Emerging Markets Risk Reward And Covid Financial Times

Settling The Debate On Emerging Markets Vs Developed Vaneck